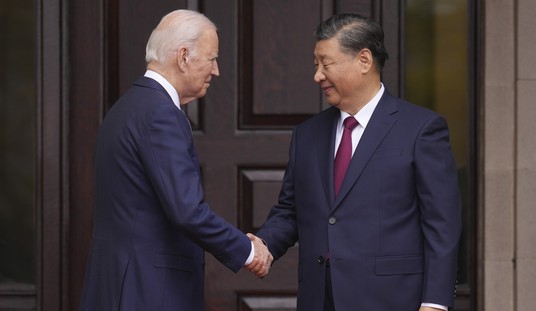

Today, the Securities and Exchange Commission approved a new rule in a 3-2 vote that will force large companies to document and disclose their greenhouse gas emissions. The rule had been in the works for more than a year and had been the subject of intense backlash from businesses and industry groups. If you find yourself wondering what in the Sam Hill the FEC has to do with greenhouse gases or climate science, you're not alone. But this is the Biden administration that we're talking about, so the Climate Goddess has to have her bony fingers in every aspect of everyone's lives. And we're not just talking about pollution here. Companies will need to analyze all of the energy they use, where that energy comes from, and how it might impact things like rising sea levels. (Washington Examiner)

The Securities and Exchange Commission released its long-anticipated rule requiring large companies to disclose their greenhouse gas emissions, after more than a year-long delay – and, as expected, the rule is a pared down version of what was originally proposed, amid attacks from industry groups and Republicans.

The rule, finalized in a 3-2 vote Wednesday, would require companies to report on their Scope 1 and Scope 2 emissions – emissions that come from sources a company owns directly, and emissions that a company causes indirectly, stemming from the source of energy it purchases and uses, respectively.

The original proposal included requirements to report on Scope 3 emissions – which encompasses those produced up and down the supply chain. There had been several reports detailing the exclusion of the Scope 3 requirement ahead of the rule’s release, after backlash from business and industry groups erupted following the release of the original draft. Many argued that compliance with the original proposal would have been too costly, and questioned whether current methods of collecting data would provide accurate disclosures.

The objections being raised to this rule are coming in from multiple directions and valid points are being raised. The American Securities Association described it as a significant overstep of the SEC's authority. They also described it as "an enormous transfer of wealth from working families and savers to the ESG professional class whose elites will reap windfall profits from the rule.”

Another business leaders group described how the rule will drain resources and money that could have gone toward keeping prices down for consumers and reinvesting in the country's economy. Instead, those funds will now be wasted on complying with a rule "that has no business existing in the first place."

Some Republican attorneys general are already threatening to go to court to block the rule. If such a case makes its way to the Supreme Court, the current justices have been much more sympathetic of late to complaints about burdens imposed by the federal government on the private sector and the working class. There is more than a fair chance that the rule could be ordered suspended while the case is being considered. If we're very lucky, that process could last until Joe Biden is (hopefully, Dear Lord) out of office and someone more sensible is put in charge at the SEC.

Returning to the original question for a moment, I will ask again... what does this have to do with the normal business of the Securities Exchange Commission? Since when are they in charge of regulating emissions and what experience does that office have in such matters? If you felt like something of this sort had to be done, wouldn't you assign the task of creating the rule and monitoring compliance to the EPA? It feels as if the elves have taken over the workshop and they are definitely up to no good.

Join the conversation as a VIP Member