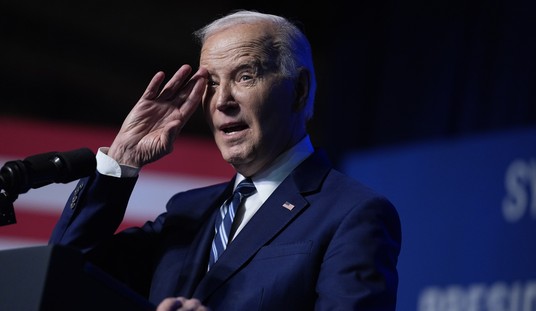

Back when the Biden administration passed the hilariously named Inflation Reduction Act (IRA), a significant debate broke out over a provision that would funnel massive amounts of money to the Internal Revenue Service. The funds would supposedly go to hire an army of new agents who would diligently work to ensure that everyone was "paying their fair share" of taxes and that government revenue was predicted to increase. Conservatives pushed back hard against the plan, but most of the IRS funding survived. Yet the anticipated benefits have still yet to show up. The reason for this, according to a new report from the Inspector General for Tax Administration is that a sufficient number of qualified people have not been applying for the new jobs at the tax agency, and the hiring process is bogged down. So why is it that people don't want these jobs? (Government Executive)

A new report from the Treasury Inspector General for Tax Administration on the initial implementation of the IRA found IRS is failing to bring on its first wave of specialists to focus on increasing compliance for large corporations, large partnerships and high-income/high-wealth individuals. The agency has made some progress—it has eliminated barriers to posting job openings—but is still facing headwinds that are largely outside of its control. Revenue agents for those roles have “yet to be hired and onboarded,” the IG said.

“External applications that have been received are far below the IRS targeted goal and there is an overall shortage of individuals with the desired background and experience,” TIGTA found.

A previous IG report found that despite its new funding, revenue agent staffing had actually decreased by 8%, or more than 650 employees, between the end of fiscal 2019 and March 2023. IRS had planned to bring on 3,833 revenue agents in fiscal 2023, but in the first six months officials had recruited just 34.

The targeted hiring goals are being missed by a wide margin. As noted in the linked report, staffing at the IRS actually fell by almost ten percent between 2019 and 2023. Since the IRA passed, the agency had planned to hire nearly 4,000 new agents last year. They actually wound up bringing on 34 new people.

The Inspector General notes that the number of people applying for these jobs is far lower than the targeted hiring goal. And among those who do apply, too many do not have the requisite background and education. There are likely a variety of reasons for this, starting with the current, low unemployment rate. There simply aren't all that many people looking for work. Also, people with a background in accounting can find jobs in the private sector that pay considerably more than the government does.

While it would be a far more difficult metric to track, it's also possible that there may be something of a stigma attached to working for the IRS in the current era. Many friends and neighbors will likely applaud you if you announce that you are enlisting in the military and they might not pay all that much attention if you go to work for another agency. But when you say that you're working for the tax man, people may be immediately reminded of how the IRS sometimes audits them. Even if not, they can't help but notice the massive bite that's taken out of their paychecks every month. That's not the fault of the individual agents of course. We need to blame Congress for that. But the association still likely remains in people's minds.

The IRS is doing what it can to combat the problem. They are dedicating more resources to bringing on recruiters and developing new advertising strategies to attract applicants. The agency has received expedited hiring authority in an effort to speed up the process, but it hasn't had much of an impact so far. The IG notes that the time between receiving an application from a qualified candidate and their actual start date is still hovering around 110 days. That's a lot of red tape to cut through when an applicant can typically be onboarded at a private sector accounting firm far faster and likely at a higher salary.

Another challenge is the fact that the IRA funds being used for this attempted expansion are temporary. Unless a new, similar bill is passed (which looks unlikely at this point), the extra money will run out in the next few years. That means that the expanded staffing levels won't be able to be maintained and some workers will either need to be let go or seek jobs in other government agencies. All of this adds up to a distinct possibility that the administration's dreams of draining the bank accounts of people who have "too much money" may have to be put on hold for a while longer.

Join the conversation as a VIP Member