A tweet from fellows I regularly check in with yesterday caught my eye. And the subject of the link was something ever so warming to the cockles of my heart.

Wouldja look at this headline, already:

Investors ditched renewable energy funds at the fastest rate on record

WHUT

Sure as shootin’, it was nothing but good news bad news. The kind that gives one hope things are truly swinging around in a big way, not just anecdotally.

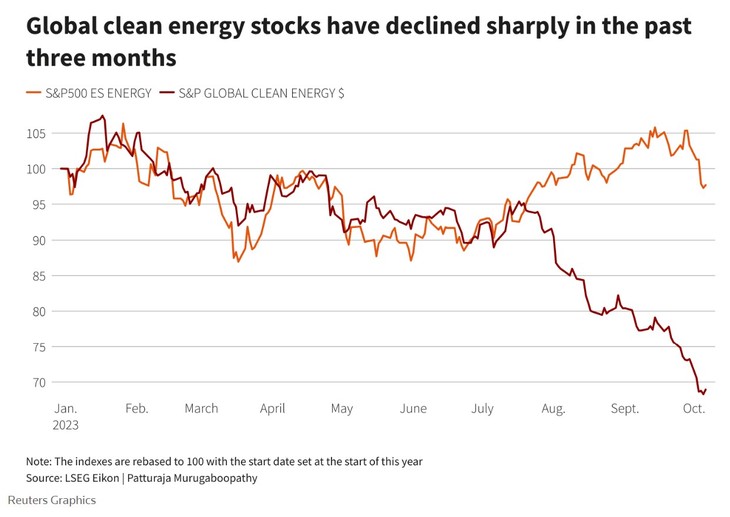

Investors ditched renewable energy funds at the fastest rate on record in the three months to end-September as cleaner energy shares took a beating from higher interest rates and soaring material costs, which are squeezing profit margins.

Renewable energy funds globally suffered a net outflow of $1.4 billion in the July-September quarter, the biggest ever quarterly outflow, according to LSEG Lipper data.

My favorite villains of the wind farm world were front and center, too. Oh, rapture.

…Renewable energy firms with high growth potential are vulnerable to rising interest rates as they eat into the value of future cash flows.

Companies including Denmark’s Orsted (ORSTED.CO), the world’s largest offshore wind farm developer, and U.S. panel maker First Solar (FSLR.O) have seen sharp share price falls in recent months.

“Renewable energy funds have faced weakened sentiment due to company performances in recent quarters and a shift in investor attention this year towards other themes like AI and U.S. Infrastructure,” said Global X research analyst Madeline Ruid.

There’s a sight for sore eyes.

The big renewables firms who are already locked into contracts for major projects have been applying pressure to governments – from the state level on up – to both jack the agreed upon pricing structure up and increase their subsidies, or they’ll walk.

As Ørsted, others seek up to 71% hike in clean energy contract prices, NYSERDA warns of rate increases

Proposals to increase offshore wind and onshore renewable energy contract prices in New York would increase residential rates by 4% a month, according to a state agency.

Governors in the US, especially on the East Coast, have been in a mad panic as they’ve watched their carefully marshalled and mandated marches to wind farms in their seas begin to fall to pieces. They are begging Biden for bailouts, as quickly as possible, because they see the writing on the wall in the court of public opinion.

Six Atlantic shore Governors are begging the Feds to bail them out of a huge looming offshore wind cost overrun. They sent Biden a joint letter asking for a list of relief measures ranging from tax breaks to revenue sharing.

The outcome is far from clear but my guess is the largess is unlikely to appear, especially given the ongoing federal budget battles. Maybe later. However most of the requests also likely require major regulatory changes, which could take years. They might even take legislation which could be never.

But the need is urgent as the offshore developers are demanding immediate power price increases of around 50% lest they leave for better opportunities elsewhere. They can do this because offshore wind is a global boom. Even mid-income developing countries like Indonesia are talking big offshore numbers.

If they don’t slamma jamma these projects through now – basically cost be damned both financial and environmental – they will almost inevitably never come to fruition.

Off the coasts of Maryland and Delaware, one of the few projects Ørsted still has going forward has starting its sonar surveying. The Skipjack 1 and Skipjack 2 wind farms are going to be plopped down square in the middle of something known as a “horseshoe crab reserve.”

Both Skipjack 1 & 2 are located in the center of the Carl Shuster Jr. Horseshoe Crab Reserve with US Wind off the coast of Ocean City, MD in the lower quadrant of the marine protected area. This MPA was created to protect the current population of crabs.

It wasn’t a dead whale, but they’ve just had an event on the beach during the surveying that has locals in shock. Something none of them has ever seen in their lifetimes and now the question arises regarding the surveying.

…Saturday, Oct, 7th we were made aware of a massive horseshoe crab beaching. This was highly concerning to us because of the surveying being done directly off the site of the stranding. The surveying is being done on behalf of US Wind and Orsted via the vessel Shacklford.

…This large stranding and debris field of crushed horseshoe crab shells occurred just north of Delaware Seaside State Park. What is disconcerting about this event is the concentrated accumulation of crabs in such a finite area. Since living in Bethany Beach for the last seven years I have seen debris fields of mixed marine life, seashells, fish and horseshoe crabs after intense storms off the coast. Usually the debris is uniformly distributed along the beach and not concentrated in just one area. These horseshoe crabs were found within about a quarter mile stretch of the beach coinciding with the timing of the geotechnical surveying being conducted just a few miles off shore.

Did the survey vessel cause the massive, localized beaching of crabs of every age and stage? There are going to be more of them and residents want an investigation before things proceed any further.

And, again, I guess crabs aren’t sexy enough for the big environmental groups to stop taking wind farm money and protect.

One of the friends I’ve made in the comments here (Thanks, John!) pinged me with a beauty of an op-ed that reflects the realities so vividly illustrated in the chart above.

The pervasive narrative about offshore wind in recent years has been that costs are falling and that wind power is cheap. But scratch below the surface and you find that things are not quite so rosy. Turbine manufacturers have been losing money hand over fist in recent years. Collectively over the past five years the top four turbine producers outside China have lost almost US$ 7 billion – and over US$ 5 billion in 2022 alone. Last year the chief executive of turbine-maker Vestas said that the company lost eight per cent on every turbine sold.

…Offshore wind projects have been drying up around the world. During the whole of 2022 there were no offshore wind investments in the EU other than a handful of small floating schemes. Several projects had been expected to reach financial close last year, but final investment decisions were delayed due to inflation, market interventions, and uncertainty about future revenues. Overall, the EU saw only 9 gigawatts worth of new turbine orders in 2022, a 47 percent drop on 2021.

…Certainly, until something changes businesses are now reluctant to keep building. Last month the latest round of the UK’s renewables subsidy programme saw no bids at all from offshore wind developers, with only two projects from last year’s round moving ahead to construction. Leading developer, Vattenfall, stopped work on its Norfolk Boreas wind farm in July, citing rising costs. A recent tender in Germany was undersubscribed – despite the target volume having been close to halved during the process, bids still came up short of capacity offered. This is by no means the first disappointing German wind auction, with bidders preferring the more commercially friendly auctions in the Netherlands.

Over in the United States, despite the massive support offered by the Inflation Reduction Act, windfarm projects are also struggling. Orsted, the global leader in offshore wind, has indicated it may write off more than US$2 billion in costs tied to three US-based projects – Ocean Wind 2 off New Jersey, Revolution Wind off Connecticut and Rhode Island, and Sunrise Wind off New York – that have not yet begun construction, saying it may withdraw from all three if it can’t find a way to make them economically viable

So struggle, struggle, struggles all over the board on top of public opinion turning against them in a big way.

When I came back to the tweet, however, there was a little Green chirpy and he’d dropped what he believed was a “gotcha” on the NetZero guys.

Have you heard that Dogger Bank wind farm has been connected to the grid? How did that story go down in the office? You often quote the Telegraph, so you can probably get past the paywall.https://t.co/TFS0Fu15ZN

— Jason. me/cfs forced retirement (@jas_mic) October 10, 2023

“Wait a minute,” I thought. I saw that Telegraph article myself. Lemme go see what this YUGE wind farm they’re all crowing about is actually doing.

You know what you find out when you DO look?

It’s a turbine. Not the farm.

One. Turbine.

In fact, ONE TURBINE is all they have assembled for however many gazillion dollars already in an ocean field that’s supposed to have TWOHUNNERTANDTWENNYSEVEN

And they got…1.

Check the bold headline against the reality. It’s…underwhelming. And a complete deflection.

World’s largest offshore wind farm produces power for the first time

...First power followed the installation of the first of GE Vernova’s ground-breaking Haliade-X 13MW turbines, one of the largest and most powerful globally, at the Dogger Bank site. This is the first time Haliade-X units have been energised offshore anywhere in the world.

Each rotation of the 107m long blades on Dogger Bank’s first operational turbine can produce enough clean energy to power an average British home for two days.

When fully complete, Dogger Bank’s world-record-beating 3.6GW capacity will comprise 277 giant offshore turbines capable of producing enough clean energy to power the equivalent of six million homes annually and deliver yearly CO2 savings equivalent to removing 1.5 million cars from the road*.

Yeah.

1.

By the way, Germany has more than 1 wind turbine, and it’s not really doing them any good either.

But they blow even more smoke than the wind industry trying to cover their asterisks.

Join the conversation as a VIP Member